King Country Senior Property Tax Exemption

A usability of a proof of concept website for seniors to check their eligiblility for property tax exemption

King Country Senior Property Tax Exemption

A usability of a proof of concept website for seniors to check their eligiblility for property tax exemption

TITLE

King County Senior Tax Exemption Usability Study

Background

We will be evaluating a proof-of-concept web form that will let qualifying senior King County homeowners apply for exemptions on their property tax. This form will be replacing a paper form that residents currently have to fill out and mail in. The form is broken up into multiple steps that include entering their parcel number and property information, checking if they meet the qualifications, entering sources of income, and uploading identification documentation.

CLIENT

We will not be working with any client directly, but have picked a product created for the King County Assessor’s Office. They had a proof-of-concept form built (by Cyndi’s company) and have yet to test it with users to see if the current design has any usability issues. Their goal is to be able to implement this form on their website to reduce the effort required for eligible seniors to apply for their tax exemption.

Graduate SCHOOL TEAM Project

Team Project in Human Centered Design and Engineering (HCDE) program to practice usability.

Colleen McDevitt

Victor Allen

Kevin Philbin

Cyndi Thompson

My ROLEs

Qualitative researcher

Semi-strutured interviews

Digital Prototyper

Sketch and lo-fi prototyping

ReseARCH Questions

How easily and successfully do participants know if they qualify for the tax exemption?

Do participants understand how to provide the necessary information requested by the tax exemption form?

Do they understand what information they need before completing the form?

Do participants get a sense for the time and effort required to fill out the form?

Do they know their progress throughout the process?

What obstacles do participants encounter while using the online tax exemption form?

Are participants able to complete the submission in one session?

If not, are they able to suspend the session and come back?

Do participants understand the benefits that result from filling in the form?

Do they learn next steps in receiving their exemption?

Target users of this form are low-income King County homeowners over the age 61. For the purposes of our testing, we will focus on recruiting senior King County homeowners regardless of income.

Target USers

Methods and Artifacts

Methods and Artifacts

KEY USABility issues

We see a number of potential issues including:

Giving users enough information so that they know whether they are just checking if they qualify for the exemption or filling out the actual form to submit it.

Making users enter personal and property information before checking if they qualify.

Giving users enough information about what they will need to complete the form before they start filling it out.

Clearly explaining the benefits that result from filling in the form.

Providing a sense for the time and effort required to fill out the form.

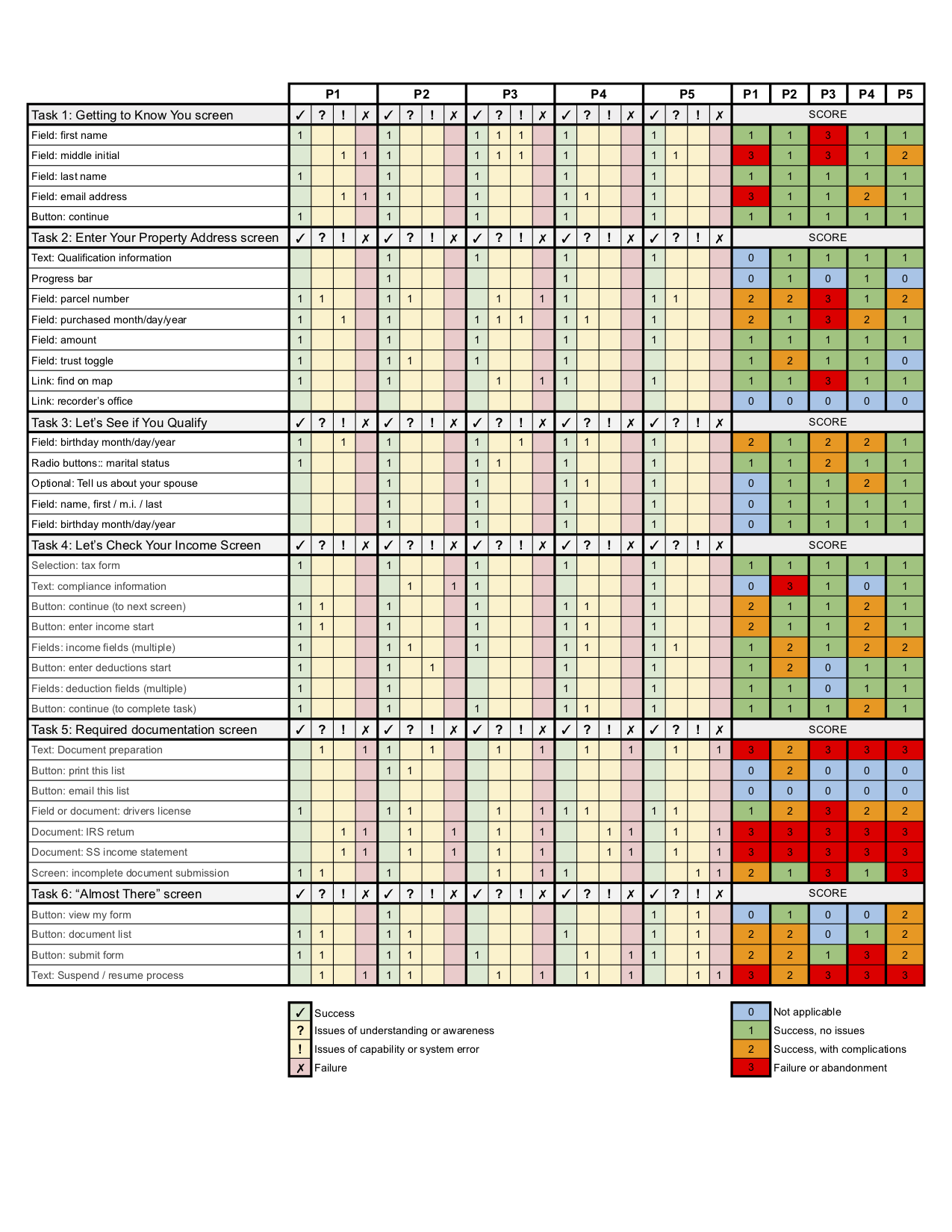

Key Tasks

Users will need to identify if they are eligible and find the link to the form starting on this page: https://www.kingcounty.gov/depts/assessor/TaxpayerAssistance/TaxRelief.aspx

Users should be able to enter their primary residence information including finding and entering their parcel number.

Users should be able to enter their qualifying information including birthdate and marital status.

Users should be able to enter their income information from their tax filings.

Users should be able to upload their required documentation (driver’s license, tax return, social security income statement).

Users should be able to submit the form without having all their documentation and return to the form via a link in their email to finish uploading documentation.

Users should be able to review the information they’ve entered before submitting the form.